Can I Back Draw From 529 Plan

You can withdraw 529 plan savings tax-free to pay for qualified education expenses, which include costs required for the enrollment and attendance at in-state, out-of-state, public and private colleges, universities or other eligible post-secondary educational institution. Qualified 529 plan expenses also include up to $10,000 per year in K-12 tuition expenses. However, if you don't follow important 529 plan withdrawal rules, you may be subject to taxes and a penalty.

It's up to the 529 plan account owner to calculate the amount of the tax-free distribution and how they want to receive the funds. You can usually make a withdrawal request on the 529 plan's website, by telephone or by mail.

Here are four steps to help you navigate the 529 plan withdrawal process and avoid paying taxes and penalties on your savings.

Step 1 – Calculate your qualified education expenses

529 plan account owners can withdraw any amount from their 529 plan, but only qualified distributions will be tax-free. The earnings portion of any non-qualified distributions must be reported on the account owner's or the beneficiary's federal income tax return and is subject to income tax and a 10% penalty.

To calculate a 529 plan beneficiary's qualified education expenses, first add up:

- College expenses , including tuition, fees, books, supplies and equipment, computers and room and board if the student is enrolled on at least a half-time basis

- K-12 tuition and fees (up to $10,000 per year)

Next, subtract any tax-free educational assistance, including:

- Tax-free scholarships

- Educational assistance through a qualifying employer program

- Veteran's educational assistance

Next, subtract the amount of any expenses used to justify the American Opportunity Tax Credit (AOTC) or Lifetime Learning Tax Credit (LLTC).

For example, a beneficiary who claims the maximum $2,500 AOTC, has $10,000 in qualified expenses and won a $2,000 tax-free scholarship may withdraw $4,000 tax-free from a 529 plan:

$10,000 – $4,000 (used to generate AOTC) – $2,000 (scholarship) = $4,000 tax-free 529 plan distribution

In this example, if the 529 plan account owner withdraws more than $4,000 the excess distribution will be considered non-qualified. The earnings portion of the non-qualified distribution is taxable, however, the 10% penalty may be waived on a non-qualified distribution up to $2,000 (the amount of the beneficiary's scholarship) . Other exceptions to the 10% penalty include:

- Tax-free educational assistance

- Receipt of education tax credits

- Attendance at a U.S. Military Service Academy

- Death or disability

- Return of excess distributions

Step 2 – Determine when to withdraw

You should take 529 plan distributions during the same year in which you paid for the qualified expenses. For example, do not include second semester tuition expenses that you paid for in December of the previous year.

Step 3 – Decide which 529 plan account to withdraw from

If the beneficiary has more than one 529 plan, consider withdrawing from a parent-owned 529 plan account first. Funds withdrawn from a grandparent-owned 529 plan count as student income on the Free Application for Federal Student Aid (FAFSA) and may hurt the student's eligibility for need-based financial aid.

However, a new FAFSA form, which is scheduled to go live on October 1, 2022, eliminates the grandparent financial aid trap. The updated FAFSA will not require students to report cash report, including money from grandparents. So, any distributions that a grandparent takes from a 529 plan in 2021 or later (due to prior-prior reporting) will not be included in the student's financial aid calculations on the FAFSA. But, grandparent support is still considered on the CSS Profile form.

Step 4 – Complete a withdrawal request

Parents can withdraw 529 plan funds by completing a withdrawal request form online. Some plans also allow 529 plan account owners to download a withdrawal request form to be mailed in or make a withdrawal request by telephone.

The withdrawal request form will typically ask for information such as:

- 529 plan account number

- Your name and social security number or Taxpayer Identification Number

- The beneficiary's name and social security number or Taxpayer Identification Number

- Phone number

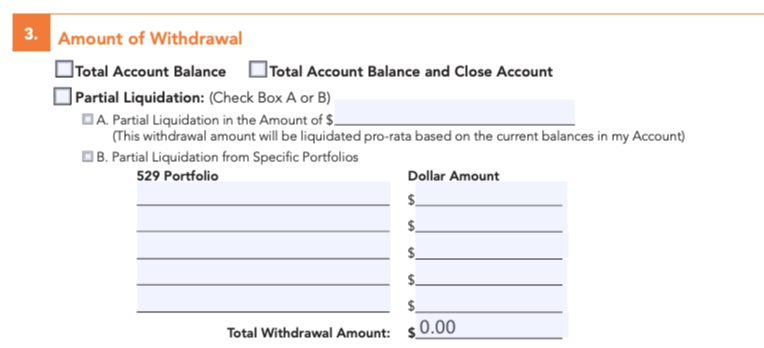

If the 529 plan account owner is taking a partial withdrawal, they will have the option to select a portfolio or portfolios to withdraw from. The total dollar amount entered from each portfolio should equal the total amount of the distribution, as shown in the image below:

Source: Brightstart College Savings Plan

If possible, avoid making the distribution payable to the account owner. When 529 plan distributions are payable to the beneficiary or the beneficiary's college or K-12 school a Form 1099-Q will be issued to the beneficiary. Non-qualified distributions payable to a parent may result in a higher tax liability.

529 plan funds can also be rolled into another account with the same beneficiary, or into a sibling's 529 plan account.

What happens to leftover funds in a 529 plan?

If there are leftover funds in a 529 plan account after the beneficiary graduates from college, or decides not to go to college, the 529 account owner may:

- Use the money to make student loan payments

- Liquidate the account and pay income tax and a 10% penalty on the earnings

- Keep the funds in the account to use for graduate school or continuing education

- Change the beneficiary to a qualifying family member who will use the funds for college

- Save the funds for a future grandchild

See also:

- Reporting 529 Plan Withdrawals on Your Tax Return

- Avoid These 529 Plan Withdrawal Traps

- How Do I Select the Right Investments for My 529 Plan?

- How Much Is Your States 529 Plan Tax Deduction Really Worth

Source: https://www.savingforcollege.com/article/how-to-withdraw-money-from-your-529-plan#:~:text=529%20plan%20account%20owners%20can,tax%20and%20a%2010%25%20penalty.